Student Loan Program

Offer Your Members a Private Student Loan Option

Corporate Central is excited to offer a comprehensive private student loan program designed to help your members cover the cost of college. Through our partnership with ISL Educational Lending, a not-for-profit organization dedicated to education funding, we provide a suite of loan options that align with our shared values of trust, transparency, and commitment to the community.

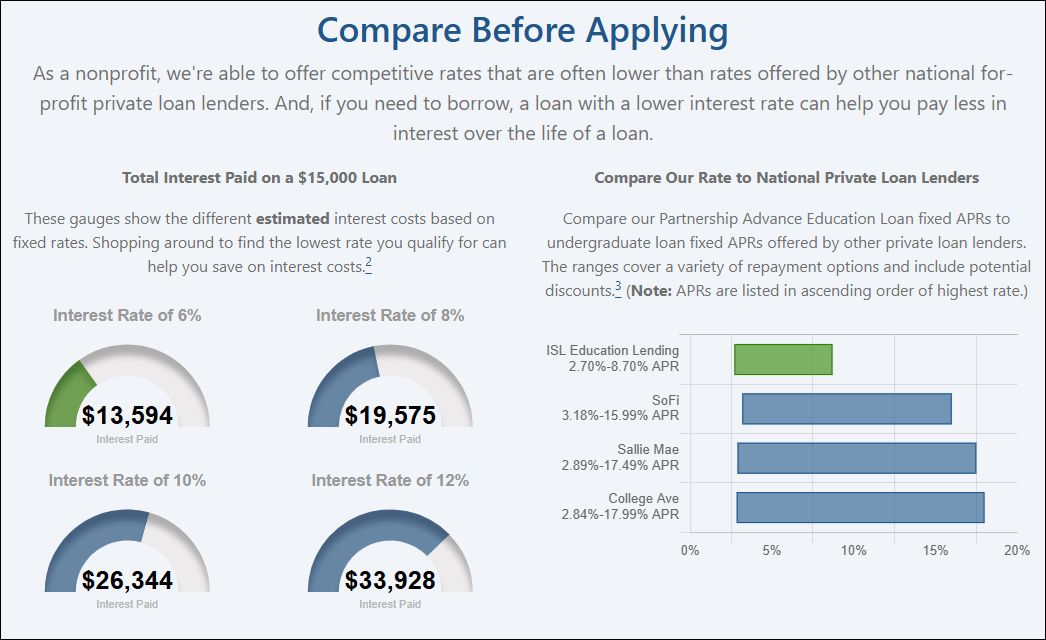

Compare ISL Education Lending’s Rates to National Lenders**

Why Partner With Us?

- Non-Profit Partnership: Both Corporate Central and ISL Educational Lending operate as not-for-profits, prioritizing the well-being of members over profits.

- Student-Centric Loan Options: Our loans cater to the unique needs of students and families, offering competitive rates and flexible repayment options. Unlike some student loan vendors, we won’t try and upsell your members additional loans.

- Competitive Rates: ISL Educational Lending has decades of experience offering lower-priced loans.*

What Our Members Are Saying:

"When I first learned that Corporate Central would be teaming up with ISL to provide credit unions with a direct link for their members to apply for students loans I was so excited. They continue to look for ways to provide value added products and services to families, both those in and outside of Iowa. I highly recommend teaming up with Corporate Central and ISL to provide the best student loan options for your members!"

Julie Pingel, Fort Dodge Family Credit Union

Loan Offerings

Advance Education Loans: | Ideal for undergraduate and graduate students, with or without a cosigner. |

College Family Loans: | Designed for creditworthy parents, family members, or friends to support students' educational expenses. |

No-Cosigner Loans: | Available for both undergrads and graduates, these loans do not require a cosigner, making them accessible to more students. |

Refinance Options: | Offering solutions for students and parents to refinance existing student loans at competitive rates. |

Benefits for Your Credit Union

Referral Income: | Earn fees by referring your members to our loan programs, adding value to your offerings without additional costs. |

Turnkey Marketing: | Receive custom digital assets, print materials, and promotional content to help you effectively share these loan options with your members. We do all the work, so you can focus on what matters most to your credit union – your members. |

Community Support: | We aim to not only provide loans for students and families but also to educate them on making informed decisions about financing college costs. We offer a quarterly newsletter with useful information for your members, along with updates and details for you and your employees. |

Get Started Today

Join us in empowering students and families to achieve their educational goals with financial support they can trust. Our turnkey onboarding makes offering private student loans a breeze to implement. Contact us to learn more about how we can work together to offer these valuable loan programs to your members.

Third-Party Servicing

Third-party servicing options include loan origination, ongoing servicing, and collection services for credit unions that have an active on-balance sheet private student loan program. In addition, we offer multiple scholarship opportunities and free college planning tools to help students and families avoid overborrowing and plan smart for life during and after college.

Need More Information?

Discover how our tailored solutions can empower your credit union.

Please note:

All loans offered by ISL Education Lending are subject to credit approval.

Before applying for a private loan, we encourage you to first complete the FAFSA, or Free Application for Federal Student Aid. You should also work with your college financial aid office to explore and exhaust all sources of student financial aid before seeking a private student loan.

*Corporate Central Credit Union is compensated by ISL Education Lending for the referral of student loan customers.

**Comparison disclaimer: Many lenders only offer limited information about their actual rates upfront. They do not provide all the rate details within the range of rates depicted on this graph. The specific rate an applicant is offered will be determined by the loan type selected and the applicant's or, if applicable, the cosigner's credit history and credit score. Annual percentage rates (APRs) were retrieved from the lenders' websites on February 2, 2026 for fixed-rate loans for student borrowers while the student is enrolled at least half time. The ranges contain rates offered to applicants with a wide range of credit scores and for a variety of repayment options and terms.

Because each lender offers different in-school repayment options and different repayment terms, an identical loan comparison between lenders is not possible. However, the APRs in the chart are listed as the highest and lowest rates for each lender and include potential rate reductions that may not apply to every borrower. For example, a 0.25% automatic payment interest rate reduction (repayment benefit) has been included for the lowest rate displayed for all lenders as well as the highest rate for SoFi and College Ave. For complete details on how APRs were calculated, visit the lenders' websites.

Before applying for a student loan from any lender, you should consider additional characteristics, including: credit requirements, monthly payment amount, origination fees, capitalization frequency, borrower benefits and protections, repayment term, when repayment begins, and the total amount to be repaid over the life of the loan.

More Solutions

Wires

We offer a full-service, secure wire transfer program, providing credit unions with streamlined domestic and international funds transfer options, robust analytics, and exceptional support to enhance compliance and reduce risk.

Vendor Management

Corporate Central partners with Ncontracts to provide Vendor Management solutions designed uniquely for credit unions to help control costs, automate operations, stay informed of approaching renewals, and meet new regulations.

Lending Options

Corporate Central offers a suite of flexible lending options, from lines of credit to fixed and variable-rate loans, designed to support credit unions with liquidity solutions that stabilize balance sheets and meet evolving business needs.