ACH Solutions: Pioneering the Future of Payments

Pioneering the Future of Payments

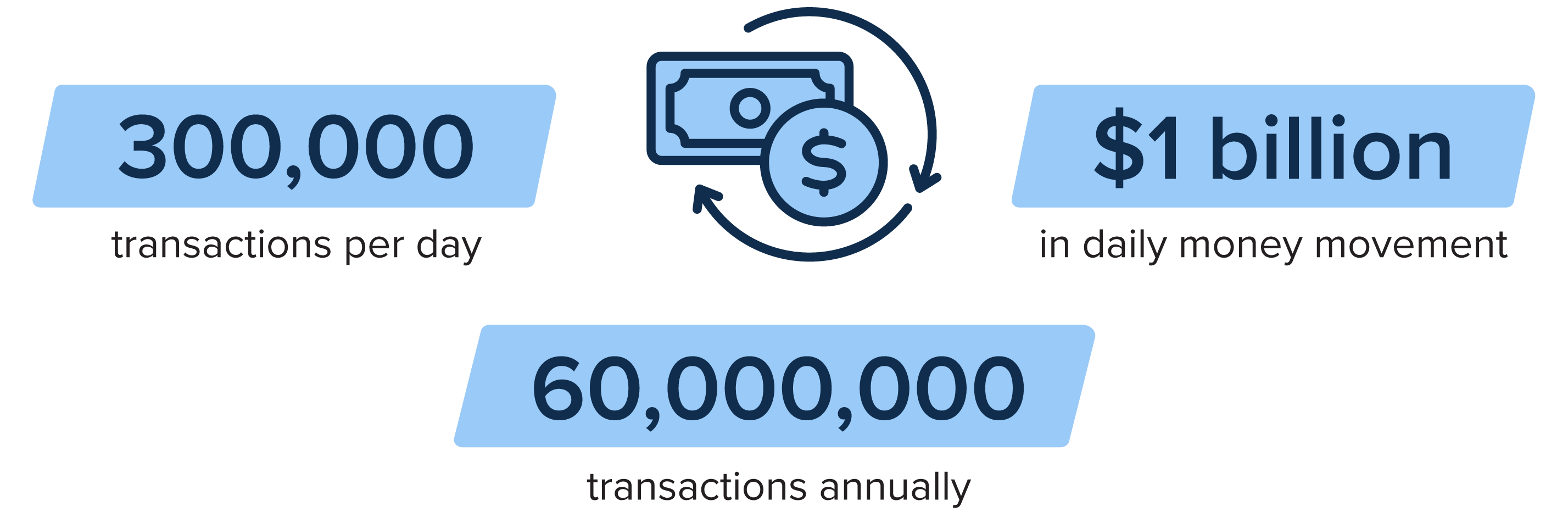

When your credit union’s members use automatic payroll, pay a bill online, or direct deposit into their accounts they are leveraging the power of the Automated Clearing House (ACH) network. ACH allows members to effortlessly send and receive electronic payments, without the extra time and fees that can be associated with wire transfers.

At Corporate Central, we are dedicated to innovation and delivering cutting-edge ACH services essential to your credit union’s operations. In 2024, we launched Beastro > Money Movement > ACH Solutions, offering seamless ACH transactions with enhanced functionality, robust security, and an intuitive interface. Beastro provides a unified, responsive platform for all money movement transactions, including not only ACH receiving and origination, but also domestic and international wires, and both internal account and member-to-member transfers.