Collaboration Corner

A Message from the President

As we reflect on another year of remarkable growth, I want to extend my deepest gratitude to all of you—our valued clients, progressive partners, and dedicated industry leaders. Thank you for your continued trust and collaboration that fuels our collective success and inspires our vision every day.

At InterLutions, we are proud to be the industry’s premier Employee Benefits CUSO, working alongside leagues, associations, CUSOs, and corporate credit unions to bring collaborative, innovative health plans to credit unions of all sizes across the country. This October alone, we welcomed 20 new clients into our CUSO family, and we are already supporting them through the health plan renewal and open enrollment season—a testament to our commitment to simplifying and enhancing benefits for credit unions and their teams.

In this issue, you will find a wealth of educational resources designed to help credit unions like yours navigate today’s benefits landscape. Please take advantage of these offerings as we continue working together to build healthier futures for all.

Thank you for an inspiring year, and here’s to the opportunities that lie ahead!

Jesse Kohl

Jesse Kohl

President of InterLutions

Resources and Updates from InterLutions

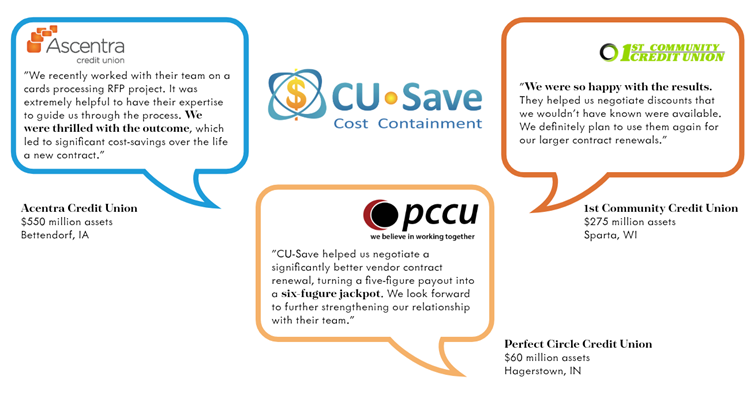

CU-Save delivers major cost savings for credit unions.

InterLutions has once again delivered impressive savings for credit unions through its CU-Save program. Partnering with the industry-leading advisory firm SRM, InterLutions recently helped 34 credit unions save a combined $10 million by negotiating improved contracts with third-party vendors. Read the Full Press Release

Understanding your health plan.

Health insurance carriers design health plans to transfer some of the risk (costs) to you through four insurance concepts: deductibles, co-insurance, co-pays, and out-of-pocket-maximums, yet most of us with insurance don’t really know what we have. Sam Boore, Employee Benefits Executive, uses practical examples to help explain health insurance costs to consumers. Read the Blog

Debunking health plan renewal myths.

Health insurance can be a complex field to understand, leading to misconceptions, misinformation, and ultimately overspending on the wrong providers. Fortunately, credit unions have a CUSO partner to help them navigate the options, debunk the myths, and chart a new path for better results. Read the Article

Can't Miss Industry Events

Join the InterLutions team in 2025 to support our partners and clients at these important events:

- Wisconsin State Government Affairs Conference

January 28 in Madison, WI | Register here

- Jam the UniCam | Nebraska Credit Union League Government Affairs Conference

February 19 in Lincoln, NE | Registration coming soon - America’s Credit Unions GAC

March 2 to March 6 in Washington, D.C. | Register here

March 2 | Bourbon and Tequila Tasting Event Sponsor with CUNA Strategic Services - Corporate Central Annual Meeting and Wisconsin Credit Union League Convention

May 7 to May 9 in Wisconsin Dells, WI | Register here

The Benefits Buzz

Industry news and articles making the rounds.

Survey finds employees prioritize better health benefits over higher salary.

Nearly three in four employed Americans would accept a job with a slightly lower salary if it offered better health care and medical coverage, including lower premiums and out-of-pocket costs. Read More

IRS announces 2025 HSA and HDHP limits.

The IRS announced 2025 new limits for health savings accounts (HSAs), high deductible health plans (HDHPs), and health reimbursement arrangements (HRAs). Explore the Article

New report shows benefits are a key to employee retention.

More than two-thirds of respondents in a recent survey said healthcare benefits are only second to salary when considering a job offer, and 78% said they would find a new job if their benefits package was inadequate. Learn More

I-Care Health Plans Are Now Available to Credit Union Business Accounts

How a credit union is bringing value to their business community.

The Challenge:

Park City Credit Union was hearing a need from their local business members to find affordable health plans that attract and retain quality employees. As medical insurance costs continue to soar, it’s imperative for credit unions to help their community members with competitive options and valuable resources. A business member with 10 employees contacted the credit union asking for assistance to provide more affordable health plan options. Their insurance network was limited, their costs were increasing, and their plan designs were costing the employees higher out-of-pocket expenses every year.

The Action:

Park City Credit Union partnered with InterLutions to help the business member secure a more viable health plan with lower costs. InterLutions’ health plan solution, called I-Care, evaluated three different insurance carriers with several plan design options and recommended a carrier that fit the exact needs of the business and its employees.

The Result:

The employer was able to save over 20% in their insurance costs while the employees enjoyed enhanced plan designs, lower copays, and extended network coverage.

Collaboration Corner

Thank you to our valuable partners. We couldn’t do it without you!

Partner Spotlight

Thank you, Park City Credit Union!

A Paperless Benefit Administration and Enrollment Solution

Five efficiencies your credit union can gain through I-Care’s digital benefit administration portal:

- Streamlined Benefits Management: Automate your process of managing employee benefits by reducing manual work and improving efficiency in tasks such as enrollment, tracking, and compliance.

- Improved Accuracy: Minimize errors in benefits calculations, deductions, and reporting by eliminating manual data entry and ensuring accurate and up-to-date information.

- Cost and Time Savings: Reduce administrative overhead, compliance management, and lower-level tasks allowing your HR team to focus on more important strategic initiatives.

- Enhanced Employee Experience: Provide employees with a self-service portal where they can view and manage their benefits, increasing transparency and engagement while offering a smoother, more user-friendly experience.

- Regulatory Compliance: Stay compliant with benefits-related regulations by automatically updating systems based on legal changes, generating required reports, and maintaining audit-ready records.

Stay Up to Date with InterLutions

Sign up to receive announcements and other notifications from InterLutions.